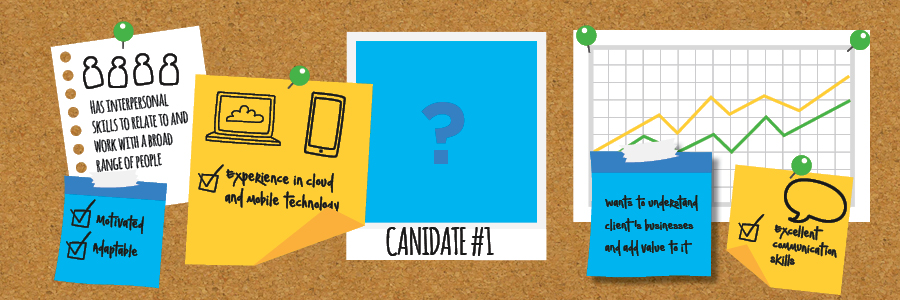

Could this be a job ad for the near future? Will interpersonal skills be on the forefront when hiring accountants?

Traditionally, the accounting profession has not been seen as agents for change. Whilst practices could be forgiven for historically adopting an “if it ain’t broke, don’t fix it” attitude, now they are having to dramatically re-think if they are to recruit, retain and reward the new generation of accountants. They have an expectation that technology fulfils, while recognising how valuable relationships and interpersonal skills are to a practice.

Currently, the accounting profession isn’t attracting anywhere near the amount of new blood that it requires. In the UK alone there is a shortfall of 10,200 qualified accountants that are needed by 2050. In order to bridge the looming skills gap, recruitment attraction initiatives, training programs and changes to recruitment processes are all evolving. For example Aston Villa have teamed up with a college to provide disadvantaged youth the opportunity to train to become budding accountants. Ernst and Young has had an overhaul of its recruitment program and processes removing all academic and education details from its trainee application process. This allows EY to choose applicants based on their performance in online tests. Both of these initiatives show the shift of emphasis in entering the accountancy profession from being purely academic achievement, to possessing certain interpersonal skill sets.

As industry bodies, marketing organisations and practices embrace this paradigm shift with technology and process at the core, as the enabler; interpersonal and inter-relational skills are increasingly becoming the key to this movement, more so than high academic achievement. To look closer at some of these trends, we talked to Darren Glanville, our UK Director of Sales, to reflect on his vast experience in the accounting industry.

What are you seeing in the shift to advisory and how are younger accountants involved in this?

With the shift to advisory work in firms, there is a growing realisation and greater emphasis being placed on the skills required to do the work. Top firms I’m working with and have worked with, are looking at skills beyond accountancy. For example, the individual’s ability to communicate, be a good listener, build strong arguments and concepts, relate to a variety of people, and whether they’re motivated. Firms are moving beyond the skills of being a stereotypical compliance focussed accountant.

I’ve also been seeing firms embracing themselves as a business, focusing on revenue generation and business development as a key motivator for their own growth. Where word of mouth and referrals were the main forms of marketing previously, firms are now having to attract and present themselves and their services to win and retain clients. Those who are doing so well, are building long lasting professional relationships with clients.

With the average age of a partner being 59, I’m also observing the rise of boutique firms. These are being driven by accountants wanting to change the status quo and not wanting to be a traditional partner. Characteristics of these firms are more corporate (less committee) leadership models, a culture of innovation with viewing change as healthy and constant, and higher-than-average trust and autonomy versus command-and-control environments. You didn’t see many firms like this even ten years ago. The profession is shaking up and it’s wonderful to see everyone involved encouraging and supporting the behaviours that change requires: collaboration, learning, and strong leadership.

What is the role of technology in changing modern practices?

Technology is a massive enabler and it’s freeing up accountant's time from doing compliance based work, to providing advisory services. The reality that people want to do business with people that they like is more evident now than ever. Technology helps build trust, foster relationships, and form lasting bonds with fellow accounting colleagues and clients in ways that just weren’t possible five or ten years ago. Some of the most engaging and profitable firms I’ve seen are switching their emphasis to derive up to seventy percent of fee income from added value services with technology being the backbone to achieving this.

Today’s younger generation accountants are a fantastic facilitator in this change, growing up in the digital era. They are wasted on data processing as their innate experience and skills lend them easily to adopting tech driven advisory roles. As more clients are going to want a deeper partnership with their firms, creating a natural progression to KPI setting, benchmarking, tax planning and advisory services - these younger accountants will thrive.

How are you seeing firms attract younger accountants?

The need to look inward and look at their rising stars and look at how their brand is also perceived externally - what do their customers really think of them? These young accountants want to be engaged with work they enjoy doing. Technology is still the driver, but there is still the human component of wanting to help and getting the satisfaction from doing so.

The firms I’m seeing attract great talent are embracing technology wholeheartedly. They have a social presence, a website, they’re creating content for their clients, answering client queries, want to impart knowledge and talk to other accountants and industry specialists, and they are agile and always looking to move their practice forward.

When you’re looking to hire it’s always great to do a skills analysis of the team as well. What skills are currently lacking? What can you increase internally? If not, is it something you need to prioritise for your next hire? This can always help cement what you need to look for and how best to attract and reach them.

As said by Vandana Saxena Poria OBE, the CEO of Get Through Guides: “Companies have to constantly think how they can exploit technology otherwise they will soon find themselves irrelevant”. By doing so, not only will you attract long lasting relationships with clients, you’ll also attract the talent in order to drive your success.