For those of us who use Spotlight Forecasting (why wouldn’t you be?!), it’s easy to get into a routine of always using the same features over and over again. But don’t forget, Spotlight Forecasting is infinitely powerful and there’s lots under the hood that you may not have uncovered yet.

From using the time-saving Loan Amortisation Rule, to performing a reality check with Comparison Pages, here are five features that will help you produce targeted, and relevant forecasts for your clients or business.

1. Loan Amortisation Rule: Secure funding and optimise repayments

Recording loans in your forecast is essential for preparing accurate and meaningful cash forecasts, however, it can be a time-consuming exercise and prone to error. With the Loan Amortisation Rule, simply enter the loan details and Spotlight Forecasting will perform the calculations and record all the relevant information in the forecast for you.

.gif?width=600&name=ezgif.com-video-to-gif%20(2).gif)

The Loan Amortisation Rule is a deceptively straightforward solution that will impress your clients, help them achieve better outcomes, and save you time. For more on the Loan Amortisation Rule, check out the help guide or blog article.

2. Dynamic Rules: One rule, dynamic change

Dynamic Rules calculate the value of an account based on another account or formula. As the figures in the base account changes, the Dynamic Rule will automatically update the values in linked accounts.

Let’s look at a quick example. Say product costs are 10% of revenue, create a Dynamic Rule using the intuitive formula builder and now as revenue changes, you’ll notice product costs updating automatically—too easy.

For more on Dynamic Rules, check out the help guide.

3. KPIs & Covenants: Measure what matters

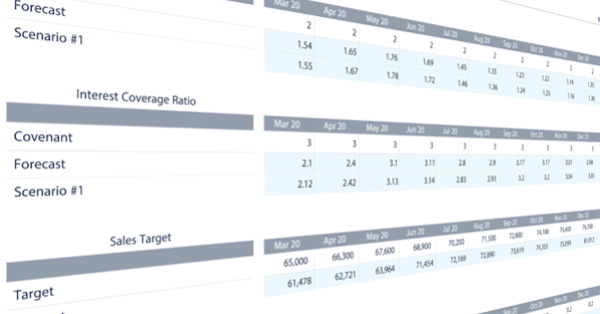

This one is very new! We introduced KPIs & Covenants in Spotlight Forecasting to strengthen your forecasting capabilities. Now you can quickly surface key performance indicators and loan covenants in one place to help monitor these metrics and to assist with decision making.

So, how would you use this? Let’s look at an example:

Debt to Equity Ratio and Interest Coverage Ratio are two metrics that businesses need to monitor. Use the drag and drop formula builder in Spotlight Forecasting to quickly create these ratios and produce a ready-to-share report for your client or Board. A quick glance at the covenants will show all actual and forecasted values for the specified time period. You’ll see how the business in question is tracking against these covenants and also the projected position based on forecast data.

For more on KPIs & Covenants, check out the help guide or blog article.

4. Driver-Based Forecasting: Connect the Dots from Driver to Success

Using Spotlight Forecasting and the power of Drivers and Dynamic Rules, it’s easy to build forecasts based on key business drivers. You choose the inputs that drive business activity—from price and quantity, through to billable hours, head-count, or even days worked. Use these drivers as the building blocks to forecast revenue, costs and the success of the business.

Pricing change? More staff to hire? Updating drivers is simple. Manage your Drivers within Spotlight and any changes you make will automatically flow through to your forecasts and scenarios, and best of all there’s no need for spreadsheets.

For more on Driver-Based Forecasting, check out the help guide or blog article.

5. Comparison Pages: Perform a reality check

Visibility and analysis are helpful when discussing the future with clients. Comparison Pages allow you to add pages to the Cashflow forecast report so you can compare actuals to forecast as well as comparing various ‘what if’ scenarios.

.gif?width=600&name=Comparisonpages%20(1).gif)

For more on Comparison Pages, check out the help guide.