The month of January is dreaded for UK accountants who are inundated with tax returns for clients. To make ‘tax season’ less stressful and to help your clients get the most out of the process, we’ve put together some guidance on how you can implement relevant technology and processes in your accounting firm throughout the year.

Education

The use of cloud accounting products has allowed accountants to have much more control over when a return is produced. However, it still involves the client to keep their records up to date. Educating the client on a monthly basis and to incorporate tools like ReceiptBank or Datamolino to capture their expenses on the go as well, is really beneficial. Demonstrating how easy the process is with little time commitment from them and providing the client up-to-date information is a great way to help. Initiatives you can try:

- Training on the technology to ensure they are using it correctly

- Blogs illustrating the process

- Send through receipts to an email address

- Infographics and guides on the process

- Reminders on existing avenues, these could be on the phone, through email campaigns or even deploying an SMS reminder system

- Specific tracked reminders using an automated reminder system, automated information catchers, or your practice management software

- Reminders on your social media channels

- In November and December, you could even deploy a reminder on your website and in your email signature so clients are constantly having passive reminders on avenues they are already using to contact you

The Super VCFO firms that have deployed these methods have seen an average decrease from twenty-five percent of clients sending in late returns to five percent.

Utilising Spotlight Reporting to Facilitate the Process

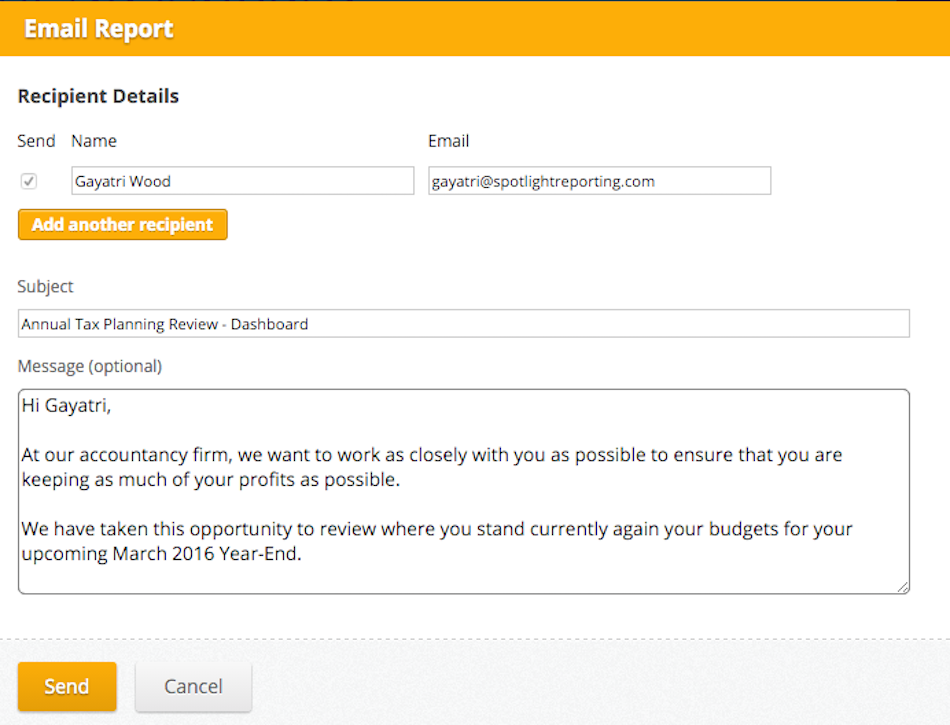

When sending monthly dashboards to your clients, you could incorporate a reminder into the dashboard itself of what should be up-to-date that month. If you’re emailing a report or dashboard to a client, you can customise the message to include a reminder as well like the one below.

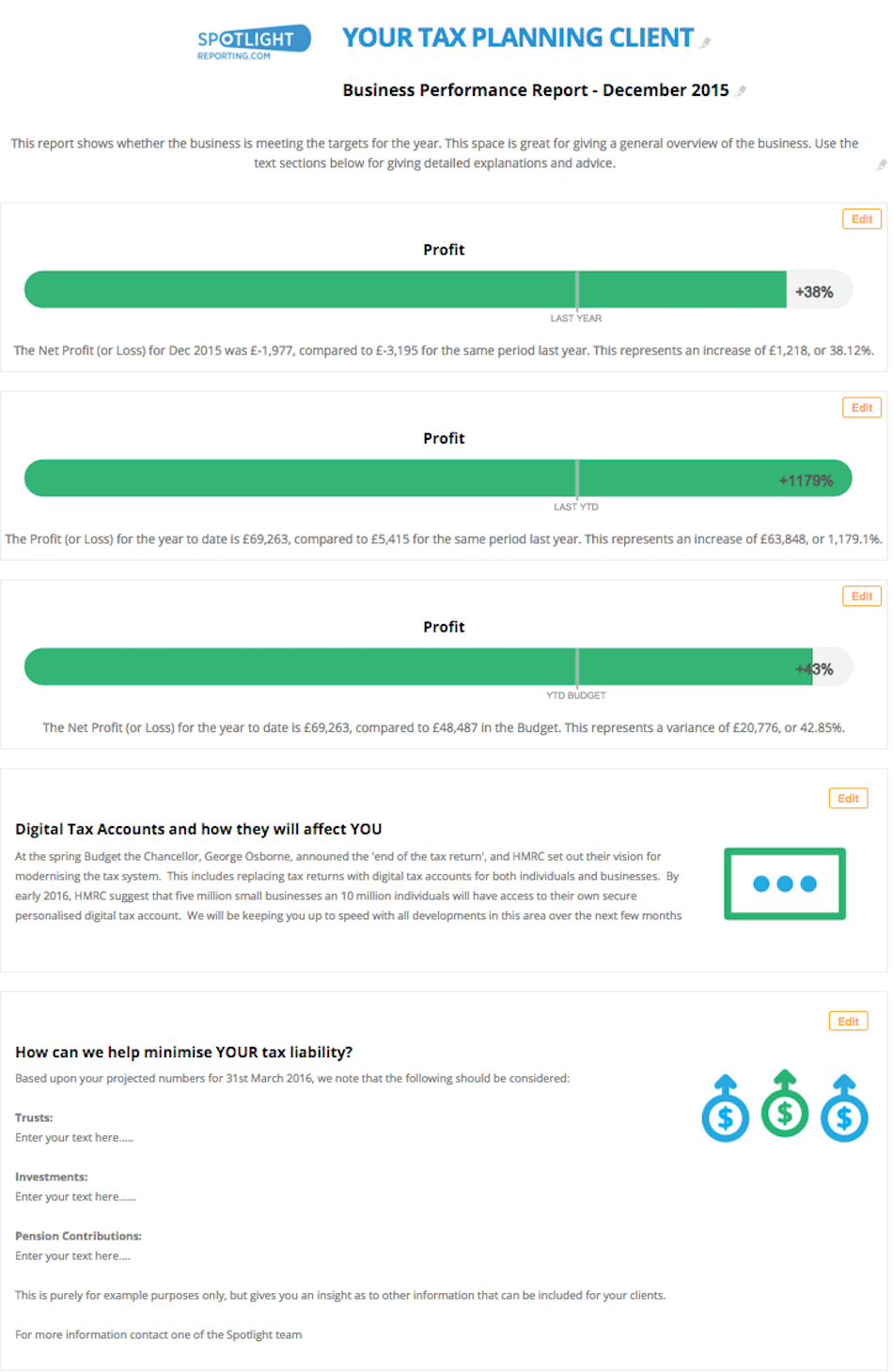

We encourage you to be proactive with your clients! Create a Business Performance Report nine to ten months into the year, measuring profit against last year. Bearing in mind the client’s budget, you can measure where you are against your revenue and their predicted tax liability. From here, you can include suggestions on how you can reduce their tax liability and ensure they have budgeted correctly to pay any tax owed. Take a look at the illustration we’ve put together below.

Additionally, you could incentivise clients to provide you with their tax return information on time. For example, offering a free basic forecast to all of those clients who got their information to you by a certain date. For those clients who are interested in the offer, you have created a scenario where you can bring the client in for a discussion about their business, provide them with a basic forecast for the next financial year, and make them aware of the additional services and advice you can provide. Utilising our forecasting tool, you could create a simple forecast for a client in twenty minutes making it a quick marketing tool you can utilise to entice your clients to keep their information up to date for you and to introduce new services.

There will always be people that despite your best efforts, will be late and don’t worry about the penalties. By utilising some of the technology and processes above throughout the year, we hope this will help you keep your sanity next January.