Understanding the finer points of your financial situation is crucial in times of economic uncertainty. But according to this recent Forbes article, a significant portion of entrepreneurs and business owners don’t fully engage with all of their financial data. This is completely understandable—not all business owners come from a financial or accounting background, and can feel at sea in the world of cashflow, budgets, and spreadsheets.

Enter Spotlight Reporting, a powerful suite of tools designed by accountants, to help businesses track the metrics that matter. When utilised to its full potential, Spotlight Reports, Forecasts, and Dashboards can empower business owners to understand their data, make better business decisions, and take control of their economic future.

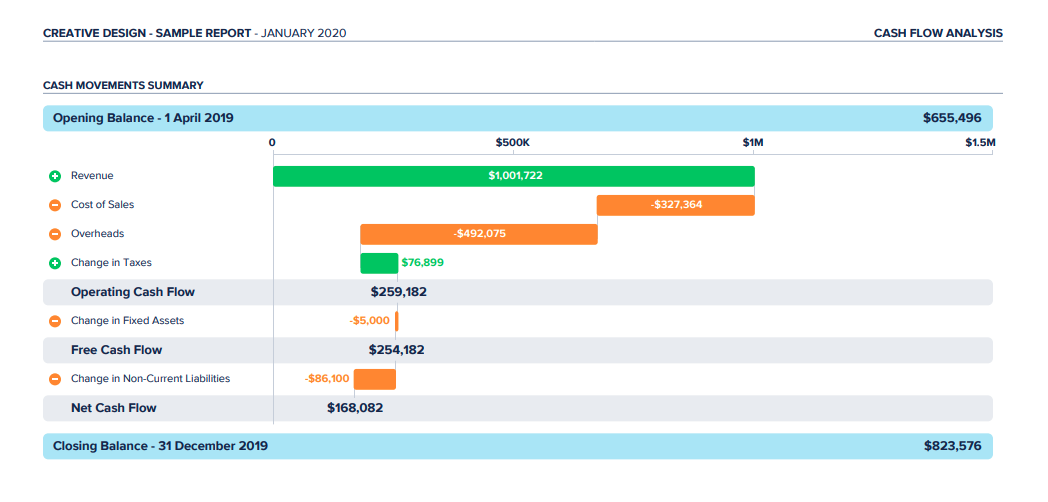

1. Data Visualisation and the Cashflow Waterfall

The most obvious immediate benefit of a Spotlight Report is the visualisation of important data in bright, easy-to-understand graphs and charts. Forget sprawling Excel spreadsheets, hefty stacks of paper, and lines and lines of seemingly disconnected numbers—Spotlight shows you exactly what you need to know, in a fraction of the time.

One example is our Cashflow Waterfall. While many business owners zero in on their profit and loss statements, a better indicator of business health is the state of their cashflow. Negative cashflow might be caused by one of many problems: lockdown restrictions, overspending, poor product demand, a stagnant business model etc, but whatever the reason, poor cashflow is eventually insurmountable.

“Businesses don’t often live or die on profit alone. The old saying, ‘profit is an opinion, cashflow’s a fact’, is very true in a crisis. There’s all sorts of accounting jiggery-pokery you can do to get the numbers to look the way you want, but if the cash isn’t coming in, it can all be over really quickly.” Richard Francis, Spotlight Reporting CEO

By using our cashflow waterfall chart, business owners can pinpoint what is pushing them into the red, and use this knowledge to balance their inflows and outflows.

2. Consolidated Reporting

For those of you who are part of a multi-entity group, consolidation is going to save you a lot of time. Instead of preparing a set of reports per entity, consolidated reporting surfaces and compares key metrics across your group in a single report, so stakeholders can evaluate performance efficiently and effectively.

Being able to identify over and underperformers in difficult periods can mean the difference between sink or swim for your company. Having the data on hand means you can spend more time and energy on those who are struggling, to help them stay buoyant. You could also survey the tactics of better performers, and implement them across the board to boost business performance. But if you don’t have holistic monthly performance insights, you might not even recognise which of your group are going under.

For franchises, Spotlight Multi takes consolidated reporting one step further with our new and improved Rankings Page, which lets you rank entities based on the metrics you choose. You can quickly surface each entity's strengths and weaknesses, and review top, bottom, median, and average results too. Best of all, you can bring it all together—quickly and accurately—in a beautifully presented report, and give your network the visibility they require to unlock growth opportunities.

Download our consolidation whitepaper or check out a Multi sample report.

3. Forecasting and Scenarios

Over the past few months, usage of Spotlight Forecasting across our customer base has grown exponentially. Creating a forecast is the first step towards understanding how to keep your business running. To get the most out of the process, create three different scenarios for the next few months—what our CEO Richard Francis calls “the good, the bad, and the ugly”:

| 1. A best-case scenario. What does the future look like if everything goes according to plan? 2. A second scenario that factors in the reality of the situation. What is most likely to happen if things continue to take a dive? 3. Get to grips with the worst-case scenario. If you’re forced to close up shop, for whatever reason, can you pivot to online sales? Do you have enough in reserve to get your business through this period? |

Our Comparison Pages allow you to compare actuals to forecasts, and track your progress. The goal of this exercise is to prepare for various scenarios. Knowing the plan before the yoghurt hits the fan is going to save you precious time and energy if it happens. The last thing you need right now is to be worrying about the future, when you’re needed in the present.

If you need help with forecasting, our Forecasting Power Hour webinars have you covered.

For more information, check out these blog posts:

- Step up with These 5 Forecasting Features

- Measure What Matters With Spotlight Forecasting KPIs and Covenants

- More Flexibility with Spotlight Forecasting’s Loan Amortisation Tool

Further Business Tips and Strategies

10 Recession-Busting Tips

Running a Business Through a Recession